Your credit score can determine where you live, where you work, your insurance premiums, loans, credit cards, mortgages and bank accounts. This three digit number literally can change your life depending on how high or low it is. With so much on the line, why settle for anything else than the perfect credit formula?

Did You Know the Impact of the Perfect Credit Formula?

Some employers will check your credit report prior to hiring you. Much like a creditor, some employers will look at your credit to

determine what kind of employee you will be. Unfortunately, they may assume a credit report with derogatory items on it means that

you are irresponsible.

Insurance companies will check a potential customer’s credit for partially determining what insurance premiums they will be considered for. Depending on your score, this can considerably affect your monthly payment. You’re probably asking yourself “why is my credit considered when determining my accident risk?”

Well, the best comparison example to this common question is the same reason insurance companies offer student discounts for good

grades; to them it reflects the driver’s level of responsibility and how the driver makes decisions. No matter how inaccurate or unfair

this may sound, it’s true!

Whether you are aware or not, your credit is also checked when renting an apartment. This unfortunately can cause some potential

renters to pay very high security deposits in order to move in, or worse, make you ineligible to live there. For many people, these

high security deposits are simply out of reach for them, and their once dream apartment is now all but a memory.

Lastly, the most common use for your score, which most consumers are aware of, is for the credit based applications. Items such as

credit cards, home mortgages, loans and bank accounts are all based on your score. The value of your score will determine whether

you are approved and what interest rate you will be considered for.

The difference between a few percentage points of an interest rate can cost you thousands of dollars! For example, the difference between a 6% and 8% interest rate on a $25,000 car loan over 60 months can cost you and additional $1500 in interest alone! How much could the perfect credit formula save you over the course of your lifetime?

Personal Credit

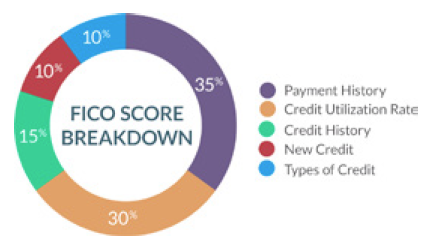

Have you ever wondered how your credit score is determined? There are five factors considered by the credit reporting agencies – Experian, Equifax and Transunion:

35% Payment History

35% Payment History

• Timing of delinquencies – was it last month or 3 years ago.

• Level of delinquencies – 30, 60, 90, 120 days late.

• Last activity date.

30% Amount Owed

• What is your total debt?

• How many accounts with balances?

• What is your overall installment and revolving utilization?

• What is your individual account utilization?

15% Length of Credit History

• How old is the oldest account?

• What is the average age of accounts?

• What is the mix of newer or older accounts?

10% Mix of Credit

• What kind of credit do you have in your file – mortgages, credit cards, loans, etc?

• The combination of credit – all the same type of credit does not look as favorably as a healthy combination of different types.

10% Inquiries

• How much new credit are you acquiring?

• The time interval between each new credit acquired – acquiring many new credit cards or loans in a short time can affect your score negatively.

• How many new accounts are on file?

FICO Scores range from 300 to 850.:

FICO Scores range from 300 to 850.:

- Excellent: 760-850

- Very Good: 700-759

- Good: 660-699

- Fair: 620-659

- Poor: 580-619

- Very Poor: 500-579

- Horrible: Less than 500

Your FICO score can be a very important consideration to qualify for a business line of credit. If you carefully manage your payment history, credit utilization, credit history, mix of credit and inquiries, you can improve your personal credit score and set you on the path to the perfect credit formula.

How Do You Get Started on the Path to the Perfect Credit Formula?

ORDER YOUR CREDIT REPORTS

Once a year you are able to order a free credit report from the three main credit bureaus. The 3 main bureaus are Equifax®, Experian®, and TransUnion®. Look at the information reported to each of the bureaus. Keep in mind that some of the information may be different due to the fact that some creditors only report to certain bureaus.

There are a number of credit report websites that you can retrieve this information from. The best credit report website for a totally free report is annualcreditreport.com. Try to review your credit report monthly in order to keep on top of your credit. You can do this by subscribing to a Credit Monitoring Service that provides a monthly update of account information.

Also if you are denied credit, employment, or insurance due to your creditworthness, you have 60 days to request a Free Credit Report after receiving a denial notice.

EXAMINE YOUR REPORTS CAREFULLY

It is sad to say, but keeping a clean credit report is your job. Credit bureaus do not verify the information they receive from creditors. Any negative information on your credit report can cost you a lot especially if you are trying to get a mortgage, personal loan, car loan, or credit card.

Once you receive your credit report look over every detail. Even the misspelling of your name or wrongly reported address is an error that can be corrected. Remember that late payments and charge-offs remain on your credit report for 7 years; Bankruptcies remain

on your report for 10 years. Making consistent payments will improve your credit over time.

DISSOLVE YOUR DEBT

The next step you can take on the path to improve your credit is to dissolve your debt. Begin by drawing up a spending plan (budget) that fits your financial status and allows you to make payments on time and consistently.

If you are having trouble making payments, call the creditor and negotiate a lower payment and/or due date. Keep in mind not to close your credit accounts after they are paid off. It will hurt your score to close the accounts then to keep them open.

Also keep your balances low on revolving accounts. This will help with keeping your interest charges down and your score will benefit from it as well.

ADD STABILITY TO YOUR CREDIT FILE

Last but not least, start rebuilding your credit file today. You may have been denied credit even though you have credit but some creditors like gas companies or credit unions, may not report to the three bureaus. If they do not, think about choosing another creditor.

The faster you begin to repair your credit, the faster your score will go up. Start now! Lenders are looking for reliable borrowers that will pay their bills on time, in full, and on a regular basis. They determine this by what is listed on your credit report, a record that is kept over a long period of time based on financial accounts in your name.

The criteria for obtaining credit can differ from lender to lender, some are based on income and some are based solely on credit history alone. Certain lenders require a perfect credit record and high credit score, and some are based solely on credit history alone. Others are more lenient and will allow a few late payments here and there.

The best way to be sure you will receive a loan or any other type of credit is the future, is to always pay bills on time. Take these steps and soon you will be on the path to the perfect credit formula.