Congratulations! You have identified the franchise or business you want to acquire or launch and are ready to get started with Small Business Administration Guaranteed Loans.

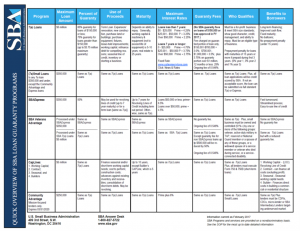

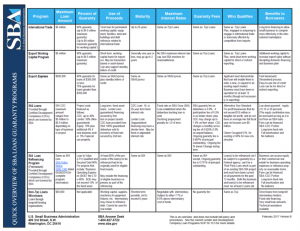

What are Small Business Administration Guaranteed Loans?

Small Business Administration Guaranteed Loans are loans backed by the Small Business Administration, providing guarantees to SBA-approved lenders for up to 85% of approved loan amounts.

The SBA doesn’t directly lend to small business owners — it backs loans made through partnering lenders, including banks, community development organizations and micro-lending institutions.

An SBA guarantee reduces risk for the lender and makes it easier for small business owners to secure financing.

Loans can be used to cover working capital needs — such as revolving credit — or fixed assets — such as real estate and equipment.

The SBA sets a cap on interest rates to limit the amount borrowers must pay back.

SBA loans are available for from as little as $50,000 to over $5 million, with terms from five to twenty-five years and current rates as low as 7.5%.

There are two approval processes that occur before lenders issue SBA loans:

- First, the lender needs to approve the business owner’s loan application.

- Then, the lender needs to apply for a guarantee from the SBA.

Pro’s of Small Business Administration Guaranteed Loans

There are many positive features of Small Business Administration Guaranteed Loans, including:

- Low interest rates

- Available for many uses

- Favorable repayment terms

- Less collateral is typically needed

Con’s of Small Business Administration Guaranteed Loans

But, Small Business Administration Guaranteed Loans are not a panacea for every aspiring Franchise or Business Owner:

- Good credit is often essential

- Down payments are typically required

- Personal guarantees are often required

- Industry-specific experience is a common prerequisite

- Extensive paperwork including detailed business plans and financial projections

The Time Challenge with Small Business Administration Guaranteed Loans

The processing time to receive your funding, after you have prepared all of the extensive paperwork, including your detailed business plans and financial projections and submitted your application to an SBA-approved lender, can range from 60 to 180 days.

If you have the time to wait, an SBA Guaranteed Loan is an excellent program to finance your new franchise or business. Of course we can work with you every step of the way to secure an SBA Guaranteed Loan.

But if you simply can’t afford to wait two to six months, Deliver Capital has many alternatives where we can get you funding in as little as two to four weeks, including:

Franchisee 401-K Rollovers for Business Start-Ups (ROBS) Programs

We can design programs that enable your franchisees to tap into their 401-K and use it for starting a business. This program can be combined with any other programs.

Unsecured Personal Term Loans for Franchise & Business Funding

Great option for client who may not have the necessary collateral to pledge for SBA or emerging brands.

• Up to $500,000 through multiple lenders

• Single-digit rates starting at 7%

• 5-7 year terms, the average is 5 years.

• Turn-around times 1-4 weeks

Franchisee Business Credit Cards

0% business or personal credit cards up to $150,000 for 12-18 months

Franchisee Equipment Financing

Get simple, fast financing for almost any franchise, with our network of equipment financing lenders, we have a home setup for your build out.

Get Started Today

Although SBA Guaranteed Loans have many positive attributes, the negatives outweigh the positives for many aspiring Franchise and Business owners.

No matter which lending program is best for you and your business, Deliver Capital can help you get the funding you need.